MCA Knowledge Centre

Aug 10 2015

Introduction

The year 2015 has ushered in a new era for compliance service providers with the introduction of two sets of new standards issued by the Ministry of Corporate Affairs (MCA) & the Central Board of Direct Taxes (CBDT) respectively. The MCA notified the Companies (Indian Accounting Standards) Rules, 2015 in February 2015 laying down the roadmap for application of IFRS converged Indian Accounting standards (Ind - AS) along with the Ind - AS standards for application by companies other than Banking Companies, Insurance Companies and Non - Banking Finance Companies (NBFCs). The CBDT vide Notification no. 32/2015 dated 31 - 03 - 2015 has notified 10 Income Computation and Disclosure Standards (ICDS) effective from 01 - 04 - 2015, applicable from Assessment Year 2016 - 17 onwards to be followed by all the assessees, following the mercantile system of accounting. The Ind - AS roadmap provides for a phase wise implementation with Ind - AS up for voluntary adoption for FY 2015 - 16 and becoming mandatory for certain class of companies from FY 2016 - 17 onwards.

I would like to begin by wishing all the readers a very Happy New Year and a productive 2016.The year 2015 has been a good year for the industry from the direct taxes perspective with the government actively working to simplify the provisions of the Act and clarifying matters of litigation such as applicability of MAT on Foreign Institutional Investors.

Rampgreen Solutions Pvt Ltd. v CIT, Delhi HC,2015

Introduction

This case law discusses the scope of functional differences filter while carrying out a comparability study for comparables within the same industry sector. The case law has elaborated how companies engaged in Knowledge Process Outsourcing (KPO) services cannot be used as comparables for conducting a Transfer Pricing study of a company engaged in Business Process Outsourcing (BPO) services, even though both KPO and BPO services fall within the broader definition of Information Technology Enabled ServicesSector.

Novo Nordisk India Pvt Ltd. v DCIT

Facts:

The assessee is an Indian company (Subsidiary of a Foreign Co.) engaged in the business of pharmaceutical products, dealing mainly in the area of diabetes treatment drugs. The assessee was purchasing finished pharmaceutical products from its AE in Denmark and distributing the same in India (Business Category – 1). The assessee was also purchasing finished goods from an unrelated Indian private limited company and distributing these products in India (Business Category – 2).

Introduction

The Indian growth story has become the toast of global investors and the growth train has been chugging along at a steady rate with strong leadership at the helm. Though right now the world economy is in a slump with the global crash of commodity prices, and India too is facing some turbulence, we still remain one of the bright spots in the world economy.

Wipro Ltd. v. DCIT

Facts of the case:

This case law is the Karnataka High Court judgment pronounced on 25th March, 2015, which covers elaborately many domestic and international tax issues. In our discussion, we shall be limiting the analysis toasignificant international tax matter covered by this case law.

Introduction

|

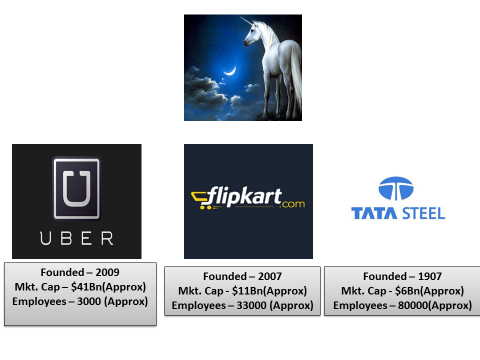

Fig. 1.1

|

Starting of a Chapter with a diagram is unorthodox. However, we are living in times of massive disruption where traditional businesses have been turned on their heads by young nimble start-ups leveraging technology. In Figure 1.1we can see how relatively new Start- Ups have gained massive Billion Dollar valuation within a short span of time gaining the popular adjective of unicorns, the mythical Norse character.

Introduction

On 29th February the Finance Minister in the Budget speech said, “Research is the driver of innovation and innovation provides a thrust to economic growth. I propose a special patent regime with 10% rate of tax on income from worldwide exploitation of patents developed and registered in India.”

Introduction

It is a common lament among the tech savvy that laws do not keep pace with the rapid rate of innovation we are experiencing currently. Practicing in Bangalore popularly known as the Silicon Valley of India, I have come across new technologies such as 3-D Printing, IoT, etc. which makes me wonder as to the laws required to regulate the same. By the time you are reading this article the budget would have just been announced and it will be hard for me draw your attention away from the budget material. However, I will make an attempt to do the near impossible by discussing a futuristic scenario from the perspective of International Taxation.